A state pursues economic policy when it wants to support its own national economy. The economic measures are aimed at achieving improved economic growth and stabilizing the price level. A functioning economic policy is characterized by a high level of employment and a stabilization of the external balance.

In this post we will deal with economic policy. We show you the importance of economic policy for the business cycle and why economic policy measures by the state are necessary. Here you can find out which instruments the state uses in economic policy and which areas are covered by economic policy. In order to deepen your knowledge, you can answer a few practice questions after the article.

English: business cycle policy

What should you know about economic policy?

In economic policy, economic policy measures are used to support the national economy. The state reacts to strong economic fluctuations with economic policy measures.

Economic policy in Germany

In Germany, the goals and means of economic policy are laid down in the Stability and Growth Act (StabG) of 1967. Current information on economic policy measures can be found in the respective annual economic report.

A business cycle consists of the following phases:

- Boom

- Boom (Boom)

- Downturn

- Low phase ( depression )

Economic policy: countercyclical economic policy

In both the boom and the depression, the state has to intervene in order to initiate another economic phase. In the boom, for example, the increase in value added tax is one of the economic policy measures. If, on the other hand, the economy is in a recession, the state lowers the value added tax in order to increase consumer demand again.

Example: Preventing Depression

At the beginning of 2020, the economy was heading for a recession. To prevent the Depression, the state lowered the VAT rate from 19% to 16%. The intended goal was achieved. Consumer demand increased again. When the economy turned from the depression to the boom, the state reset VAT to the original rate.

Why is economic policy necessary?

According to foodezine, economic policy is always pursued when fluctuations in the economy become evident. The measures are aimed at maintaining a stable economic situation and the business cycle is to be interrupted.

According to the StabG, the goals of government economic policy are:

- Stability of the price level

- High level of employment (also called full employment)

- External balance

- Steady and appropriate economic growth

If the economy of a country is in a recession or a depression, the economic policy measures of the state are particularly necessary. Lower consumer demand is the trigger for companies to no longer sell their products in the desired quantities. The result of this is that companies are scaling back or even stopping the production of their goods. Because the production stop means that employees are no longer needed, the company is laying off its employees. Unemployment is increasing.

To prevent a depression or stop a recession, the state can lower VAT. This tax is levied on all goods and services that are bought or provided in an economy. By making products cheaper, the state stimulates the economy. The upswing follows the depression.

Which instruments are used in economic policy?

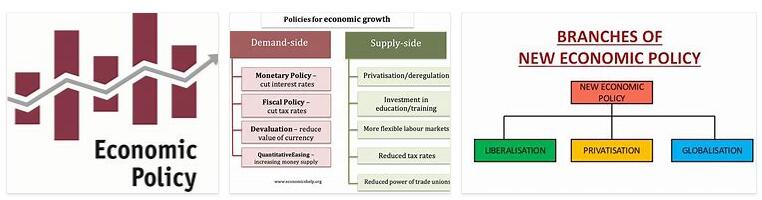

The instruments used in economic policy can be distinguished as follows:

- Fiscal Policy Instruments

- Monetary Policy Instruments

Fiscal Policy Instruments

One of the fiscal policy instruments of the state is primarily the reduction of value added tax. This is intended to encourage private households to consume more. In addition, the fiscal policy instruments also provide for subsidies in the economy in order to increase the willingness of companies to invest.

Monetary Policy Instruments

Monetary policy instruments is the state one when the present in the economy money supply changed or – in Europe – about the European Central Bank on the interest rate applied.

The key interest rate is the determining interest rate at which a commercial bank borrows money from the ECB. If the ECB raises the key interest rate, savers and investors will benefit. Lowering the key interest rate means that companies will have to factor in fewer costs when taking out a loan.

Example: Use of monetary policy instruments

In order to stimulate the economy again, the European Central Bank decides to lower the key interest rate. This benefits an entrepreneur who takes out a loan from his house bank to finance a production machine. The bank grants the loan with conditions that provide for a lower interest rate for the repayment.

Other areas of economic policy

The economic policy of a state also covers the following areas:

- Foreign trade policy

- Wage policy

Foreign trade policy

In foreign trade policy, the focus is on international economic relations. The economic policy measures of the state encompass the entire movement of goods, services and capital at the international level.

In addition to improving international relations, one of the goals of foreign trade policy is to secure its own economic growth. Domestic companies should be protected from foreign competition.

The measures that the state takes in foreign trade policy are, for example, export subsidies, which are intended to promote exports. On the other hand, imports should be restricted and subject to customs duties.

Wage policy

The wage policy is not operated by the state itself. In the industries and economic sectors in which there are collective agreements, employees and employers’ associations negotiate the various contractual provisions. Workers are represented in collective bargaining by the trade unions.

Example: collective agreements

The train drivers employed by Deutsche Bahn are paid according to a collective agreement that the train drivers’ union negotiated with the employer representatives.