The demand oligopoly is a variant of the oligopoly. It is characterized by the fact that many providers want to sell their products, with the demand being low. The challenge of a demand oligopoly is to arouse customers’ interest in buying. This is often only possible through lower prices. The market form can often be found in retail, when a large corporation manifests its position of power through lower prices.

In this lesson you will learn about the demand oligopoly, its importance in an economy and the dangers and risks associated with it. The practice questions at the end of the lesson will help you test and manifest the knowledge you have learned.

English: demand oligolopy

The importance of demand oligopolies in an economy

In the context of oligopolies, the question arises as to what causes the imperfection of markets. Why is there almost complete competition in some industries, while some industries are dominated by a small number of companies ? Most cases of incomplete competition, such as the oligopoly of demand, can be traced back to two main causes.

Causes of incomplete competition:

- There tend to be fewer suppliers in an economic sector if economies of scaleand the associated cost reduction in production are of particular importance. Under these framework conditions it is possible for companies to produce cheaper, so that the smaller companies are undercut and are often not viable.

- Markets also tend towards incomplete competition when new companies have to overcome barriers to market entry.

What are economies of scale?

Economies of scale refer to economies of scale. They arise from the fact that the unit costs incurred in the company for a product decrease with increasing production volume and thus with the size of the company.

In this respect, economies of scale describe the cost advantages of mass production, which are the basis for the competitive strategy of cost leadership. This results in higher profits or a larger market share for the company.

What are barriers to market entry?

According to eshaoxing, market entry barriers are factors that make it difficult for newly founded companies to gain a foothold in an economic sector. If the threshold is high, the number of companies is likely to be manageable, with the result that competitive pressure is limited. These factors include high entry costs and legal restrictions, among others.

The oligopoly of demand within the oligopolies

The term oligopoly can be used to distinguish between three different types of market forms that result from the different relationships between supply and demand on the market.

Supply oligopoly and demand oligopoly

Three different types of oligopolies:

- Demand oligopoly

- Supply oligopoly

- Bilateral oligopoly

Demand oligopoly

The demand oligopoly is a type of market in which a large number of suppliers face a small number of buyers. This means that many vendors want to sell their products, and the actual demand for these products is low.

In a demand oligopoly, it is difficult to arouse the interest of customers to buy. This can often only be achieved by lowering prices.

Examples of demand oligopolies

- Many farmers sell their beets to a small number of sugar refineries that process the beets into sugar.

- The client is the state, which publicly puts the construction of a bridge out to tender. A large number of construction companies then apply.

- Many farmers sell their milk to a few dairies who process the milk further.

Supply oligopoly

The supply oligopoly is the opposite of the demand oligopoly. In contrast to the demand oligopoly, there are not a few, but many demanders and also few suppliers.

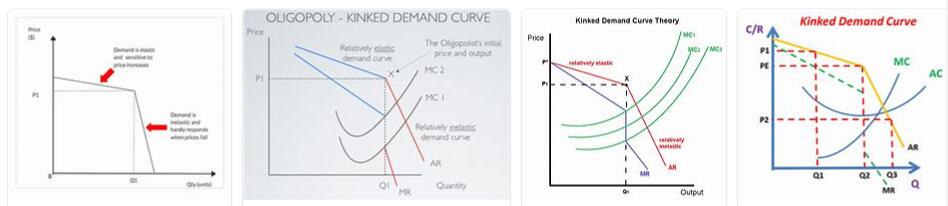

In theory, this type of market is ideal for trading companies because the competition is manageable. However, with a supply oligopoly it is easily possible for customers to compare the prices and conditions of the few providers with one another. This can be detrimental to companies as soon as a provider lowers prices. For the other companies, this often means that they have to follow suit.

Bilateral oligopoly

In a bilateral oligopoly, few suppliers meet few buyers. This situation occurs especially when a specific product is only of interest to specific customers. Examples are manufacturers of luxury sedans who offer special and, in particular, expensive vehicle bodies.

The number of customers who can afford a luxury model is correspondingly low. Companies must therefore succeed in acquiring the few interested customers and persuading them to buy, although there is room for maneuver in terms of pricing.

The emergence of oligopolies

Oligopolies are not uncommon in an economy and can be found in important economic areas.

Factors that favor the formation of an oligopoly:

- The emergence of oligopolies is favored if the goods offered on a market are relatively similar and the demand can essentially be met. For example, it makes relatively little difference to consumers which provider covers the energy demand. Entry into the market is particularly difficult for new market providers due to the high investment requirements, so that there is hardly any chance that the number of providers will increase.

- Another factor that promotes the formation of oligopolies is the high pressure to concentrate on the part of suppliers, which is particularly prevalent among automobile manufacturers. To be successful, you need a high level of technology and innovation that a smaller provider cannot match. Instead, there are mergers in the automotive industry and the formation of oligopolies.

Dangers and risks of demand oligopolies

- Pressure on dealers: There are only a few manufacturers on the market for some product groups. However, a large number of trading companies are interested in selling these products. This situation enables the manufacturers to strongly influence the conditions. If a trading company does not accept this, there are numerous other dealers available to the manufacturer. This means that smaller trading groups are exposed to enormous pressure in this way, as the manufacturers can play off the various traders against each other.

- Incorrect pricing: The demand oligopoly is not without its dangers for businesses when it comes to pricing. If wrong decisions are made in this regard, it can happen that market shares are frivolously gambled away. If the pricing is incorrect, the manufacturer may reorient itself and give preference to other trading companies.

- Price changes risky: Competitors can gain advantages over their competitors and in this way take over the price leadership. If market leaders vary the price, the others will follow without the need for a price agreement. Conversely, smaller providers hardly have a chance to implement price changes if the large providers don’t follow suit.

- Displacement: The market leadership of one provider can lead to ruinous cutthroat competition to the disadvantage of the other providers, which in turn can have negative effects on the overall economy.

- Monopoly risk: In imitation, one actor tries to imitate another actor’s successful pricing. If only two actors exist, they can achieve a monopoly price through this behavior.

- Market power of the provider: The provider side has great market power. This means that the setting of prices, conditions and production quantities does not have to be based on consumer demand, so that there is ample room for maneuver to the detriment of consumers.

- Cartel formation favors: Due to the generous room for maneuver, oligopolies are suspected of forming cartel-like structures that are to the detriment of customers. Examples are petrol stations that are suspected of circumventing competition through illegal price fixing.

In Germany, oligopolists do not want to work together. Price fixing and the formation of cartels are to be prevented. The relevant legal basis is the Act against Restraints of Competition (GWB).

The Federal Cartel Office, which is responsible for enforcing and complying with the GWB, has existed since 1958. It also deals with cartel agreements, cartel formation and merger control, also known as merger control. Its purpose is to prevent the formation of harmful oligopolies and an excessive concentration of economic power.