The gross value added is an economic indicator that only records the added value created in the production process. It is calculated by deducting intermediate consumption from production values and is valued at production prices, i.e. without taxes and taking into account subsidies on goods. As part of the production approach can be selected from the gross value added GDP calculated.

In this lesson we explain the meaning of gross value added and show you how it is calculated. At the end you will have the opportunity to put your newly acquired knowledge to the test with a few exercises.

English: Gross value added

Why should you know gross value added?

According to aviationopedia, the gross value added is one of the most important economic indicators and is part of the generation calculation, on the basis of which the gross domestic product is calculated. It is therefore also essential for determining the national accounts (VGR), as it corresponds to the services provided by the individual economic sectors.

Determination of gross value added

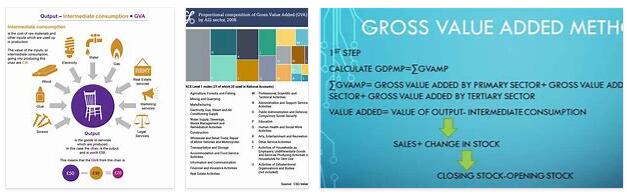

The determination of the gross value added is a necessary component in order to be able to calculate the gross domestic product as part of the production calculation.

This is done by adding up the production values of the companies or the individual economic sectors. A company’s output value is the totality of sales and services, which are then valued at market prices. In addition, there are trade goods to other economic entities, whereby VAT is always disregarded.

The production value for the following economic sectors is then calculated using the production costs:

- Agriculture, forestry and fishing

- construction industry

- Manufacturing

- Commerce, hospitality and transport

- Financing, rental and business services

- Public and private service providers

Calculation

The output values of the economic sectors listed here are determined individually and then added up in order to obtain the overall economic output value as the result. However, it is important here that all advance payments are deducted. Otherwise, the result would be too high due to double counting.

The general formula for calculating gross value added is therefore:

Determination of gross value added

When making the calculation, care must therefore be taken to deduct all goods and services that one economic entity has previously received from another in order to use it for its own production.

The cumulative value added of all economic sectors is also the “unadjusted gross value added”. In order to calculate the adjusted gross value added and thus the gross domestic product from this, the imputed bank charges are also deducted.

| Production values of all economic sectors at market prices | |

| – | Advance payments |

| = | Value creation of the economic sectors |

| = | unadjusted gross value added |

| – | imputed bank charges |

| = | adjusted gross value added |

Example: Calculating the gross value added

A furniture manufacturer purchases raw materials worth € 50 per piece for the production of a filing shelf. He sells the finished product for € 75 to an office furniture wholesaler, who delivers the shelf to specialist office equipment stores for € 100 each. They then offer the shelf to their customers for sale for € 125.

If one were to proceed as follows, simply adding up the revenues of the individual companies, the calculation would look like this:

50 € + 75 € + 100 € + 125 € = 350 €

The original value of the raw materials would be included seven times in this value, since the prices were added here, but not the pure value added. The result would be too high gross value added. If the advance payments are deducted, the invoice looks like this:

50 € + (75 € – 50 €) + (100 € – 50 € – 25 €) + (125 € – 50 € – 25 € – 25 €) = 125 €

The gross value added thus corresponds to the retail price of the specialist shop.